It has been argued that a fixed money stop in a mean reversion system is actually antithesis to risk aversion. In other words, in the long run you will actually end up risking (losing) more by using a fixed $ stop. This form of system is betting the market will eventually turn back in the favor of the longer term trend. If this is it’s rationale then why in the world would you want to use a protective stop. If accounts were funded properly according to the actual size of the futures contract, then the percentage loss on any given trade is diluted. A $5000 loss on a $125k account looks and feels a lot different than a $5000 loss on $25K. A retail account, one where leverage is taken advantage of, requires a safety net, not necessarily from a mechanical perspective but from a psychological one. Knowing the fixed amount of loss prior to the entry of a trade provides the comfort level that allows a retail client to actually pull the trigger.

Here is Euclid sans stop:

Nice results but look at 3. One huge loss – at a $25k trading level would the trader stick with the trade?

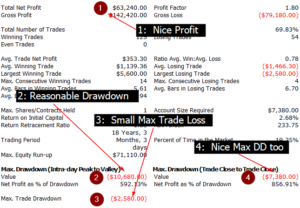

Here is Euclid with a reasonable protective $Stop:

Similar results but the biggest one trade loss was around $2600. Okay answer this question. Would you prefer to risk $10K on any given trade or would you rather have 4 losing trades in a row at $2500 a piece? Knowing that you will end up at the same place – probably. Most retail accounts will take the latter. The security blanked aspect is a big plus. There also exists an esoteric side-effect to using a stop with mean reversion. Take a look at the last two trades of Euclid. The system entered and got stopped out and then re-entered at a much better price. Had a stop not been utilized the system would not have gotten out and back in at a much better price. A two trade net winner would have just been a one trade winner, albeit small. This can also work the other way. Just saying…..