Stocks were down big last week. Led lower by the “FAANG”s. ES is testings it’s 200 day Moving Average. Will it bounce?

Quant X Systems Latest Trades Updated and Notes

QuantXSysems Update (Report Card)

The summer has treated the systems quite well and you can see the latest trades here. We have made one modification to Euclid – the max risk has now been reduced to $2500. This is the stop that will be generated when a trade is initiated – slippage and commission may increase this amount. In the September 2018 Striker Report, Euclid was ranked in the top ten in the $30,000 account size category. We have added a day trade system –Archimedes to the mix. This is a good alternative for those clients who do not like to hold positions over night. As you can tell by the latest trades it has done well this summer too.

Euclid gets an A! After the first big loss, it has bounced back nicely and is at all time equity highs.

Turing gets a B. It hasn’t overcome the last big loss, but it turned a loser into a small winner on the last trade.

Mandelbrot gets an A! Its had six winners in a row. As of this post it is in another trade that is teetering between a winner and a loser.

Archimedes gets an B! The last test scores has brought the overall grade up to an B. Prior to the August trades this system was just a typical student treading water.

Remember:

ALL results on this site are HYPOTHETICAL unless otherwise noted. Past performance is not necessarily indicative of future results. HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS. STAFFORD TRADING HAS HAD NO EXPERIENCE IN TRADING ACTUAL ACCOUNTS ON THIS SYSTEM. BECAUSE THERE ARE NO ACTUAL TRADING RESULTS TO COMPARE TO THE HYPOTHETICAL PERFORMANCE RESULTS, CUSTOMERS SHOULD BE PARTICULARLY WARY OF PLACING UNDUE RELIANCE ON THESE HYPOTHETICAL PERFORMANCE RESULTS

Is A Protective $ Stop Necessary In Mean Reversion

It has been argued that a fixed money stop in a mean reversion system is actually antithesis to risk aversion. In other words, in the long run you will actually end up risking (losing) more by using a fixed $ stop. This form of system is betting the market will eventually turn back in the favor of the longer term trend. If this is it’s rationale then why in the world would you want to use a protective stop. If accounts were funded properly according to the actual size of the futures contract, then the percentage loss on any given trade is diluted. A $5000 loss on a $125k account looks and feels a lot different than a $5000 loss on $25K. A retail account, one where leverage is taken advantage of, requires a safety net, not necessarily from a mechanical perspective but from a psychological one. Knowing the fixed amount of loss prior to the entry of a trade provides the comfort level that allows a retail client to actually pull the trigger.

Here is Euclid sans stop:

Nice results but look at 3. One huge loss – at a $25k trading level would the trader stick with the trade?

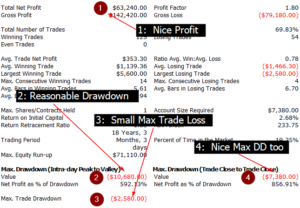

Here is Euclid with a reasonable protective $Stop:

Similar results but the biggest one trade loss was around $2600. Okay answer this question. Would you prefer to risk $10K on any given trade or would you rather have 4 losing trades in a row at $2500 a piece? Knowing that you will end up at the same place – probably. Most retail accounts will take the latter. The security blanked aspect is a big plus. There also exists an esoteric side-effect to using a stop with mean reversion. Take a look at the last two trades of Euclid. The system entered and got stopped out and then re-entered at a much better price. Had a stop not been utilized the system would not have gotten out and back in at a much better price. A two trade net winner would have just been a one trade winner, albeit small. This can also work the other way. Just saying…..

Hello world!

Welcome to WordPress. This is your first post. Edit or delete it, then start blogging!